Starting with Humana Medicare Supplement Insurance Plans, this paragraph aims to provide an engaging overview of the topic, highlighting the key features and advantages.

Humana offers a range of Medicare Supplement plans designed to fill the gaps in original Medicare coverage, providing peace of mind and financial protection for beneficiaries.

Overview of Humana Medicare Supplement Insurance Plans

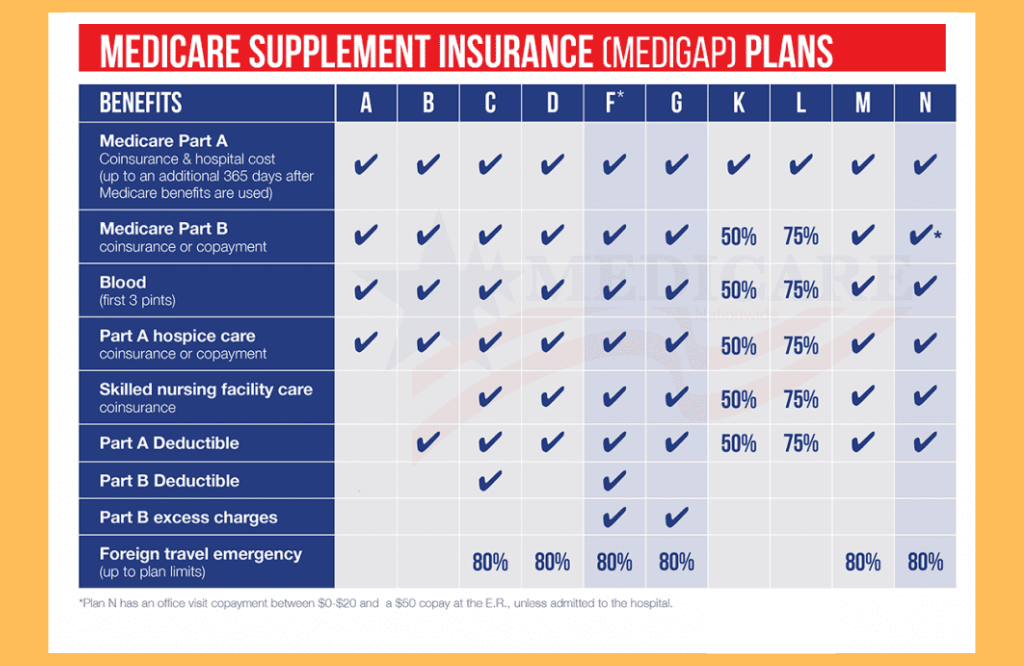

Medicare Supplement Insurance Plans offered by Humana are designed to provide additional coverage beyond what Original Medicare offers. These plans help cover costs such as copayments, coinsurance, and deductibles that beneficiaries would otherwise have to pay out of pocket. Humana offers various plans with different levels of coverage to suit individual needs.

Types of Humana Medicare Supplement Insurance Plans

- Plan A: Basic benefits including Medicare Part A coinsurance and hospital costs.

- Plan B: Includes Plan A benefits plus Medicare Part A deductible.

- Plan F: Comprehensive coverage including all Medicare deductibles, coinsurance, and excess charges.

- Plan G: Similar to Plan F but does not cover Medicare Part B deductible.

- Plan N: Provides coverage for Medicare Part A coinsurance, hospital costs, and some copayments.

Network Coverage and Providers

Humana’s Medicare Supplement plans allow beneficiaries to choose their healthcare providers without the need for referrals. The plans work with any doctor or healthcare facility that accepts Medicare patients, giving beneficiaries the flexibility to receive care from a wide range of providers.

Cost and Pricing

The cost of Humana Medicare Supplement Insurance Plans varies depending on factors such as age, location, and the type of plan chosen. Plan F typically has higher premiums due to its comprehensive coverage, while Plan N may offer lower premiums with some cost-sharing. It’s important to compare the pricing structure of each plan to find one that fits your budget.

Enrolment Process and Deadlines

To enroll in a Humana Medicare Supplement Insurance Plan, individuals need to be enrolled in Medicare Part A and Part B. The best time to enroll is during the open enrollment period, which starts when you turn 65 and lasts for six months. After this period, you may still be eligible to enroll, but you could be subject to medical underwriting.

Additional Benefits and Extra Coverage

In addition to the core benefits, Humana offers extra coverage options such as vision, dental, and fitness programs to enhance the overall healthcare experience for beneficiaries. These additional benefits can help fill gaps in coverage and provide added value to individuals seeking comprehensive healthcare solutions.

Final Conclusion

In conclusion, Humana Medicare Supplement Insurance Plans offer a comprehensive solution to healthcare needs, with flexible coverage options and additional benefits that enhance the overall experience for beneficiaries.

Helpful Answers: Humana Medicare Supplement Insurance Plans

What are the different types of Medicare Supplement plans offered by Humana?

Humana offers various types of plans, such as Plan A, Plan B, Plan F, Plan G, and Plan N, each with different coverage levels and costs.

How does network coverage work with Humana Medicare Supplement Insurance Plans?

Humana has a wide network of healthcare providers and facilities, allowing beneficiaries to choose their preferred doctors and hospitals within the network.

Can individuals switch or make changes to their Humana Medicare Supplement Insurance Plans?

Yes, individuals can make changes during certain enrollment periods or under special circumstances, ensuring flexibility in managing their healthcare coverage.